Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Operational technology (OT) – i.e. industrial control, automation and critical infrastructure systems – has become a pillar of digital transformation in industry. The convergence of OT with classic IT systems is gaining momentum with the development of Industry 4.0. As a result, Polish companies are increasingly investing in automation, Industrial IoT (IIoT) and OT cyber security to increase the efficiency, competitiveness and operational resilience of their plants.

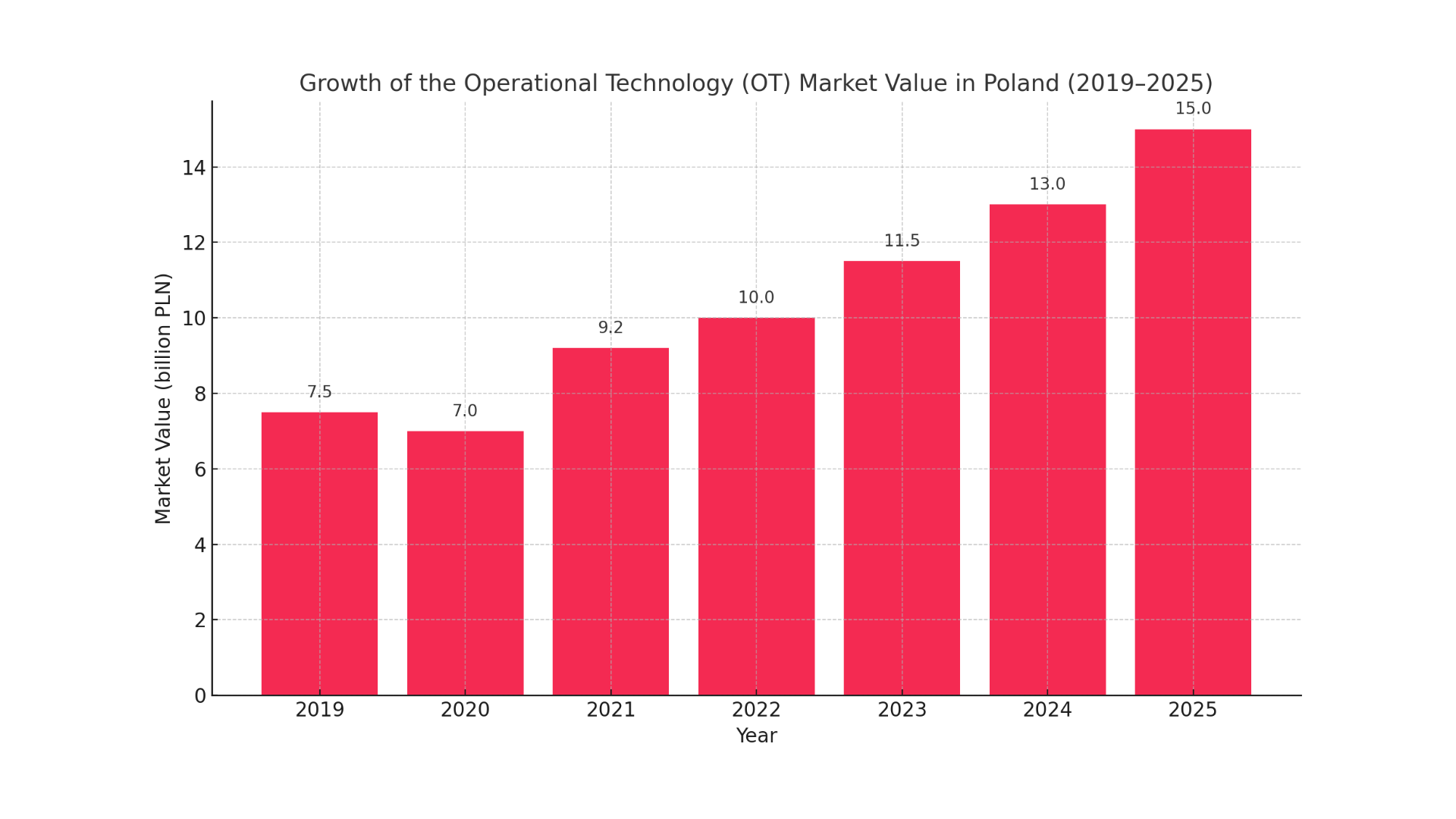

The Polish OT market has been growing rapidly in recent years, almost doubling in value from 2019 to 2024. It is estimated that in 2019, the value of the domestic OT market was around PLN 6-7 billion, while in 2024 it is already reaching over PLN 13 billion, despite a periodic slowdown during the pandemic. Such significant growth – averaging around 15% per year – reflects the increasing demand for industrial automation solutions, SCADA/PLC systems, IT/OT integration and security services in industrial environments. For example, the Industrial Internet of Things (IIoT) segment in Poland reached a value of around PLN 10 billion in 2023, growing by 20% year-on-year. The domestic industrial automation and robotics industry has also grown strongly, with more than 210 companies already operating in it, generating a total of more than PLN 9 billion in revenue annually. The growth of the market is driven by the need to increase productivity and reduce costs: companies are investing in OT to increase productivity, precision and process safety, reduce human error and cope with skills shortages.

The outlook for the OT market in Poland remains very optimistic. Maintaining a double-digit growth rate suggests that this market will exceed PLN 15-16 billion in 2025, and could reach PLN 30 billion by 2030 (i.e. another doubling of scale). These forecasts correspond with global trends – the global IT/OT convergence market (comprising OT and IT software and OT hardware) is valued at US$720bn in 2023, and IoT Analytics predicts it will grow by 8.5% per year to over US$1 trillion in 2027. The OT cyber security segment, on the other hand, is expected to grow globally at up to 15-25% per year, reaching USD 80-120 billion in 2030. Poland – as an economy catching up in terms of automation – may maintain a double-digit OT growth rate in the current decade as well. It is worth noting that these forecasts depend on a number of factors, including the industrial conjuncture, the availability of engineering staff and the pace of regulatory implementation (e.g. the NIS2 directive on critical infrastructure). Nevertheless, the trend is clear: operational technologies will become an increasingly important part of the ICT market in Poland, and investments in this area will accelerate as the concept of Industry 4.0 matures.

The development of the OT market is being driven by technological changes that are transforming traditional factories into modern, digital factories. Key trends include:

The average annual growth rate of the Polish OT market between 2019 and 2024 was estimated to be around 15 per cent (CAGR) – a rate higher than that of the overall ICT market. Growth was primarily driven by demand in three vertical sectors: manufacturing, energy and transport and logistics.

It is worth noting that, in addition to those mentioned, significant adopters of OT technologies include the food sector (many food production lines are already highly automated), the mining sector (mines are implementing OT systems for safety and control) and the healthcare sector (HVAC and power automation in hospitals, medical IoT devices). Even local governments are investing in urban IoT systems (smart lighting, environmental monitoring), which also falls into the broad area of OT.

Overall, demand for OT in Poland is multi-sectoral, but industry, energy and transport are the cornerstones and will account for the largest share of market growth in the coming years. Each of these sectors is driven by slightly different motivations – industry by productivity and lack of manpower, energy by grid reliability and ecological transformation, transport by efficiency and safety – but the common denominator is a shift towards OT as a solution to strategic challenges.

The Polish operational technology market is entering a mature growth phase. As shown, we can expect further dynamic growth until 2030, with OT becoming a permanent item on the investment agenda of many companies. For IT and business executives, this means a number of strategic actions need to be taken:

1. accelerating IT/OT convergence: today’s companies can no longer afford silos – IT systems (e.g. ERP, analytics) must work seamlessly with OT systems in production. Integration of these environments should become part of a company’s digital strategy. A plan should be in place to connect operational data with office systems, enabling new business benefits from analysing production data in a broader context. However, IT managers must remember that IT/OT integration requires trade-offs and specialised expertise – it is worth investing in team training and working with integrators with experience in both areas. Companies that are first to successfully integrate OT with IT will gain the advantage of more efficient operations and faster access to information from the 'factory floor’.

2 Investment in OT security and resilience: any industrial transformation initiative must go hand in hand with strengthening cyber security. The risk of cyber attacks on operational infrastructure is real and growing – high-profile incidents (such as the ransomware attack on Colonial Pipeline) have demonstrated the consequences for critical infrastructure. Managers should assume that their OT environments will sooner or later become the target of an attack, especially if they are connected to the IT network. It is recommended to implement a Zero Trust model in the OT area – treating every access and device as potentially hostile, network segmentation and strong access control. Visibility of OT assets is also necessary – investment in industrial network monitoring systems that can detect abnormal device behaviour before failure or sabotage occurs. Management should also take care to develop business continuity plans (BCP/DR) that take into account OT technology downtime, as well as meeting regulatory requirements (NIS2 compliance audit, implementation of security standards). OT cyber-security budgets will have to grow – but it is a necessary investment to protect production continuity and the company’s reputation.

3. development of team competencies and a culture of collaboration: The shortage of OT security experts and automation engineers familiar with IT is a barrier that companies already face today. Managers should therefore invest in upgrading the skills of existing staff – e.g. by training automation engineers in cyber security and networking, and IT specialists in the basics of industrial systems. It is worth considering the creation of joint IT/OT teams or at least mechanisms for ongoing collaboration between these departments to break down 'traditional organisational silos’. Building a culture where IT specialists understand production priorities (continuity, physical security) and OT engineers understand cyber hygiene principles and IT procedures is key. The staffing gap can be partially bridged by working with external managed service providers (MSSPs) that offer, for example, SOC monitoring for OT or industrial network management – but this is no substitute for internal awareness and competence. IT leaders should therefore include dedicated OT-related roles (e.g. OT Security Officer or OT Systems Engineer) in their staffing plans.

4 Long-term planning and innovation: When thinking about the future, executives should already be considering new technology waves on the horizon, such as Industry 5.0, augmented reality (AR) in factories, or the use of digital twin technology for process simulation. Although these concepts are only in their infancy, investments in OT are inherently long-term – the life cycle of industrial systems is often 10-15 years. Therefore, decisions made today (e.g. the choice of automation platform or communication standard) will affect a company’s ability to implement further innovations a decade from now. Managers should design an OT architecture that is open to future expansion, compliant with standards (this will facilitate the integration of new AI/IIoT modules in the future). It is equally important to pilot innovations – such as launching proof-of-concept programmes for AI in maintenance or 5G in the factory – so that the organisation learns new technologies before they become mainstream.

The development of the OT market in Poland is accelerating, reflecting the industry’s transformation towards modern, automated and intelligent operations. Historical data shows strong growth in the value of the market, and forecasts suggest a continuation of this trend in the coming years. Key trends – from automation, to IIoT and AI, to IT/OT integration and cyber-security – are setting the stage for businesses seeking greater efficiency and resilience. For IT managers and technology decision-makers, this means they need to actively engage in OT projects: combining IT and OT competencies, investing in security, training and innovation to take full advantage of the opportunities of Industrial Revolution 4.0 (and in the future 5.0). Polish industry faces a huge opportunity – the right decisions taken today will determine whether indigenous companies will be at the vanguard of the new era of operational technology or remain merely passive recipients of it.