Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

IT outsourcing, at its core, is a strategic partnership where organisations outsource the management, development or maintenance of key technology processes. With the dynamic changes in the global economy and accelerated digital transformation, outsourcing has evolved from a cost-cutting tactic into a fundamental element of business strategy. It enables companies to not only focus on their core business, but also provides access to specialist competencies, resource scalability and operational optimisation.

In the context of Poland’s growing position on the global IT services map, a complex question arises about the nature of outsourcing in this country: is it merely a fad driven by the search for quick savings, a 'necessity’ resulting from global talent shortages and relentless innovation pressure, or a potential 'trap’ carrying hidden risks and threats to the stability of outsourcing companies and contractors? This article will attempt to unravel this question by analysing the growth dynamics of outsourcing contracts against data on IT company insolvencies.

International recognition and rankings

Poland has consistently maintained its position as one of the world’s most attractive locations for business services and IT outsourcing. This is confirmed by numerous reports from leading analyst firms. For example, in Deloitte’s 2023 Global Shared Services and Outsourcing Survey report, Poland was identified as the second most popular location for service centres, behind only India and ahead of Mexico, the United States and Malaysia. Similarly, the KPMG report ranks Poland as the second most preferred outsourcing location, behind India and ahead of Brazil. This consistently high ranking underlines the global recognition of the Polish IT ecosystem.

Poland’s persistently high position in the global IT outsourcing rankings is a phenomenon of deeper significance than just a confirmation of cost competitiveness. The fact that Poland has been in the top spot for years demonstrates that the market perceives it as a mature, reliable and strategic partner, and not just a temporary solution to reduce expenses. This enduring market position is due to a combination of high quality talent, English language proficiency and cultural compatibility with Western markets, all of which go beyond simple cost arbitrage. The shift from seeing Poland as a place to cut costs to seeing it as a source of added value and innovation is key. This means that IT outsourcing in Poland is not a temporary 'fad’ that will pass with changing market conditions, but has become a strategic 'necessity’ for global companies looking for robust, long-term IT solutions and innovation opportunities.

Size and dynamics of the Polish IT outsourcing market

The Polish IT/ICT sector is a significant driver of economic growth. In 2018, it accounted for around 8% of the country’s GDP and employed 430,000 people. The most recent ABSL data for Q1 2024 shows that the contribution of the entire business services sector to GDP increased to 5.3%, which, while it may reflect a different methodology or a broader range of services than IT/ICT alone, confirms its significant contribution to the economy.

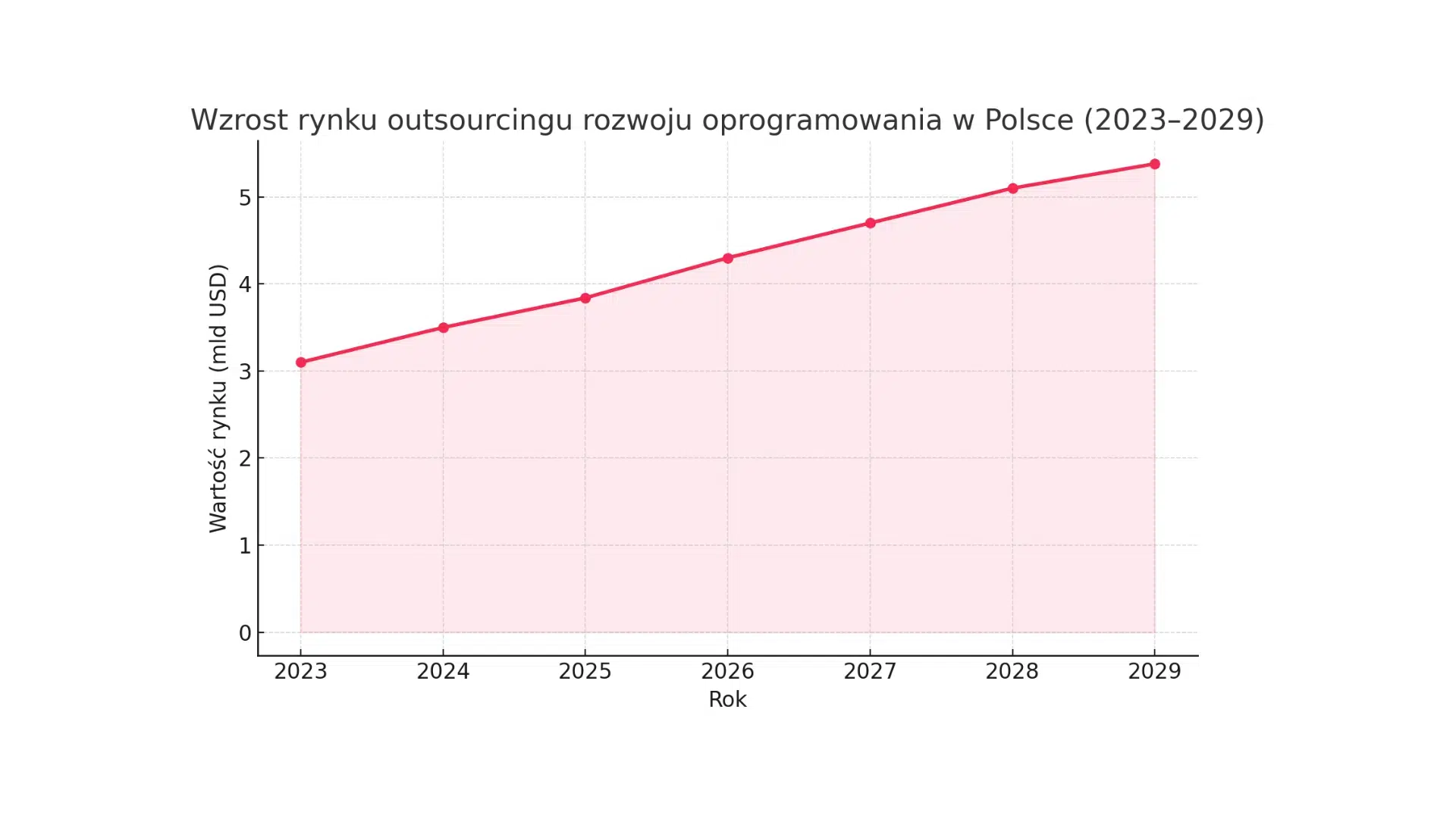

The IT market in Poland is experiencing impressive revenue growth. Revenues from the software market in Poland are forecast at USD 10.44 billion by the end of 2025. In particular, the software development outsourcing segment in Poland is expected to reach USD 3.84 billion over the same period, with further growth projected to reach USD 5.38 billion by 2029. The overall IT sector in Poland is expected to grow at a compound annual growth rate (CAGR) of 5.92%, reaching more than USD 13 billion by 2029.

The pool of IT professionals in Poland is huge and growing, which is a key asset. Numbers range from 255,000 to over 520,000 or even 600,000 depending on the source and year, making Poland the largest talent hub in the Central and Eastern European (CEE) region. The ABSL report for Q1 2024 shows that employment in the entire business services sector exceeded 457.1k, with a forecast for further growth to 471.6k by Q1 2025.

The increase in the number of outsourcing contracts in Poland is a direct consequence of the global demand for IT services and the ability of the Polish market to meet this demand. There is a significant global shortage of IT talent, which is cited as a major barrier to business transformation by 63 per cent of company leaders in the 2025-2030 outlook . In this situation, Poland, with its large and growing pool of highly skilled IT professionals, is becoming a key solution for international companies. Poland’s ability to provide the necessary human capital in the face of a global talent shortage transforms this shortage into a significant opportunity for the Polish IT sector. This dynamic clearly positions IT outsourcing in Poland as a strategic 'must’ for companies seeking to overcome staffing constraints and maintain competitive advantage.

Key success factors and competitive advantages

The Polish IT outsourcing market is distinguished by a number of strengths that contribute to its strong global position:

The synergy of these strengths creates a sustainable competitive advantage for Poland in the global IT outsourcing market and changes the perception of the market. Having at the same time a huge and highly qualified talent pool, competitive costs, a stable legal and economic environment and high cultural compatibility, Poland offers a unique value proposition. It is not just the sum of individual advantages, but their interplay that allows Polish companies to engage in increasingly complex and knowledge-intensive projects, as evidenced by the growing share of such services in the business services sector. This comprehensive offering means that Poland’s dominant position in IT outsourcing is not a temporary 'fad’ that will falter with minor changes in global cost structures. Instead, it is based on fundamental, structural advantages that make it a compelling 'must’ for companies seeking long-term, high-quality and secure IT partnerships. The potential 'pitfalls’ of outsourcing in Poland, if any, are therefore less related to the inherent flaws of the Polish market itself and more to the due diligence of the client in choosing the right partner and managing the outsourcing relationship effectively.

Evolution of the motivation to outsource

Global trends in IT outsourcing clearly indicate an evolution in companies’ motivations. While cost reduction was the main objective in 2020 (70% of companies), today, while optimising spend remains important (34%), companies increasingly value access to specialist talent (42%), flexibility (35%), high service quality (33%) and global delivery (33%). This shift in priorities signals a strategic transformation in the perception of outsourcing – from a cost-cutting tool to a key partnership to support business growth and innovation.

This shift in motivations is closely linked to the global IT talent shortage. Research shows that the skills shortage is the biggest barrier to business transformation for 63% of company leaders between 2025 and 2030. In this situation, IT outsourcing, especially to countries such as Poland that have a rich and highly skilled talent pool, is no longer just an optimisation option. It is becoming a fundamental „strategic necessity” for companies that need to acquire specialised IT competencies in order to achieve their digital transformation goals and remain competitive. Poland, with more than 520,000 IT professionals and around 15,000 IT graduates per year , is effectively filling this gap, turning the global talent deficit into its competitive advantage. This trend confirms that outsourcing in Poland is not a 'fad’, but a sustainable part of a global sourcing strategy.

The role of outsourcing in accelerating digital transformation

Outsourcing is now seen as a key strategy in accelerating digital transformation. Companies are investing heavily in cloud services, which was particularly evident during the pandemic. Poland has the potential to become a leader in cloud services, supported by the launch of local cloud regions by Google and Microsoft, thanks to significant investments and developed competences.

Adoption of Generative Artificial Intelligence (GenAI) is another powerful driver of global IT spending, with projected growth of 9.8 per cent in 2025 to US$5.61 trillion, and 50 per cent of employers planning to reorient their business in response to AI. The Polish market for AI software development is expected to exceed USD 5.8 billion by 2030 , demonstrating the growing competence in this area. Cyber security is a priority for 71% of business leaders, with 81% of companies choosing to outsource security functions due to the high cost of data breaches.

IT outsourcing, especially to Poland, which is actively developing competencies in GenAI, cloud and cyber security, is becoming a key accelerator of innovation and adaptability for companies. Companies not only reduce operating costs, but above all gain rapid access to advanced technologies and specialists, which is essential for their future growth and maintaining a competitive advantage. The focus on these areas, rather than simple infrastructure maintenance, shows that outsourcing has evolved into a strategic partnership. Poland, with its extensive IT infrastructure and innovation centres , is well placed to meet these demands, confirming the thesis of the 'necessity’ of outsourcing in the context of a dynamically changing technological landscape and increasing pressure for innovation.

Growth in outsourcing contracts – data and forecasts

The software development outsourcing market in Poland is expected to reach USD 3.84 billion in 2025 and USD 5.38 billion by 2029. The business services sector in Poland as a whole recorded a year-on-year employment growth of 3.8% in Q1 2024, with further growth forecast to 471,600 employees by Q1 2025. What’s more, knowledge intensive business services (KIBS) exports from Poland reached an impressive USD 36.8 billion in 2023, a year-on-year increase of 22.9%.

The continued growth in the number of contracts and value of outsourcing services exports in Poland is a strong indicator of the growing confidence of global companies in the Polish IT ecosystem. Such dynamics are not a feature of short-term 'fashion’ that will quickly pass, but rather reflect strategic decisions based on Poland’s proven ability to deliver high quality services, innovation and stability. The fact that foreign centres dominate new investments and job creation in the Polish business services sector , further confirms the deep strategic integration. This growth demonstrates that outsourcing in Poland is perceived as a stable and future-proof business 'necessity’ that is an integral part of the long-term strategies of global companies.

Despite its many advantages, IT outsourcing, like any business strategy, comes with potential pitfalls and challenges that need to be consciously managed.

The main risks associated with outsourcing

The aforementioned risks associated with IT outsourcing do not result from fundamental weaknesses or instability of the Polish IT market. Rather, they are universal challenges that accompany the management of any relationship with an external service provider, regardless of location. Their materialisation depends largely on the diligence, strategy and due diligence of the outsourcing company. Poland, thanks to its convenient time zone, high English language proficiency and cultural compatibility with Western markets , significantly mitigates some of these risks compared to traditional offshore destinations. Legal risks, although specific to the Polish context, are fully manageable through expert consultation. This means that outsourcing in itself is not inherently a 'trap’, but requires conscious and proactive risk management. Focusing on these aspects is crucial for a successful collaboration.

The specifics of 'IT per hour’ versus comprehensive outsourcing partnerships

Risk analysis requires distinguishing between different outsourcing models. The article points out in detail the specific pitfalls associated with less structured and fragmented IT services, such as the 'IT per hour’ model. These include:

The risks associated with the 'IT on an hourly basis’ model are much higher and fundamentally different from those of working with large, mature outsourcing companies in Poland. These larger entities, such as those mentioned in the ABSL report, are characterised by structured processes, comprehensive teams, project and risk management mechanisms, and provide substitutability and a wide range of competencies. In this way, they minimise the problems of availability, quality or security that are inherent in less formal and scaled forms of outsourcing. This means that while the 'trap’ exists in the context of single, unstructured services, it is not representative of the mature Polish IT services market, which leans towards comprehensive, long-term partnerships. This distinction is key to accurately assessing the risks and choosing the right model of cooperation.

Risk minimisation strategies

To effectively manage risk in IT outsourcing and avoid potential pitfalls, companies should implement the following strategies:

A key element in assessing the nature of IT outsourcing in Poland is to analyse its impact on the stability of the local IT sector, particularly in terms of the number of company bankruptcies.

Dynamics of bankruptcies in the IT sector in Poland

The overall number of bankruptcy proceedings in Poland has increased in recent years. Data from the Central Statistical Office (CSO) shows an increase in the number of insolvencies in Q2 and Q3 2024, although a decrease was recorded in January 2025. Coface reports a record 5576 insolvencies in 2024, an increase of 19% compared to 2023, with the highest growth in construction and transport. There were 100 insolvencies in Q1 2025, unchanged year-on-year, but higher than in Q4 2024 (95 insolvencies).

However, when analysing the 'Information and Communication’ sector (PKD J), the picture is much more stable. In 2021, a year in which the overall number of new businesses in Poland increased by 12.4% and the number of insolvencies fell by nearly 30%, the Information and Communication sector stood out as having the largest increase in new business registrations (by nearly 43%). Significantly, in the same year, the Information and Communication sector saw only nine insolvencies, accounting for just over 2% of all business failures.

The above data shows that the number of bankruptcies in the IT/ICT sector in Poland remains relatively low and stable compared to the overall insolvency dynamics in the economy. Despite an overall decline in business registrations in Q4 2024, including the largest in information and communication (by 17.7%) , this does not translate directly into an increase in the number of insolvencies in this sector.

The main causes of company bankruptcies in Poland, such as excessive operating costs, lack of a growth strategy, dishonest counterparties, liquidity problems, excessive debt or strong competition, are universal and affect all sectors. There is no specific data to indicate that the IT sector is particularly exposed to these factors in a way that would lead to mass bankruptcies, especially in the context of the growth of outsourcing contracts.

No direct negative correlation

When comparing the dynamic growth of outsourcing contracts and the overall development of the IT sector in Poland (as presented in Section 3) with the data on bankruptcies in the „Information and Communication” sector, no direct negative correlation is observed. On the contrary, despite the general increase in the number of insolvencies in the Polish economy, the number of bankruptcies in the IT/ICT sector remains relatively low and stable.

This situation suggests that the increase in the number of outsourcing contracts does not lead to a wave of bankruptcies among Polish IT companies. In fact, it can be said to be a stabilising and strengthening factor for the sector. The growing demand for outsourcing services, especially in the areas of advanced technologies and specialised competence, provides Polish IT companies with a steady stream of orders and development opportunities. Access to global markets and a diversified customer base help them maintain liquidity and resilience to economic fluctuations that may affect other, less specialised industries.

Implications for the market

The lack of a negative correlation between the growth of outsourcing contracts and IT company bankruptcies has important implications. It indicates the maturity and resilience of the Polish IT sector, which is effectively taking advantage of the global demand for its services. Rather than being a 'trap’ leading to bankruptcy, outsourcing is proving to be an engine for growth, stability and innovation. IT companies in Poland, especially those involved in outsourcing, appear to be well prepared to manage operational and financial risks, benefiting from a growing number of international partnerships. This strengthens Poland’s position as a reliable and secure partner in the global IT supply chain.